Domingo 12 de enero de 2014

The overstated pessimism over Latin America

Fuente:

Vox Eu

Autor:

Augusto de la Torre, Eduardo Levy Yeyati, Samuel Pienknagura

There is a wave of fashionable pessimism over Latin America’s future. Expressions such as 'submerging economies' and 'the party is over' have become common in analysts’ and investors’ parlance and, while mainly applied to the BRICS (Brazil, Russia, India, China, and South Africa), they have also contaminated perceptions about Latin America. This marks a major turnaround in sentiment, which not too long ago had nothing but praises for the region’s decade of stellar economic and social progress, as illustrated by´┐ŻThe Economist's contrasting twin covers on Brazil (November 2009: “Brazil takes off”; September 2013: “Has Brazil blown it?”).

To be sure, the global environment is no longer emerging markets-friendly. The softening of Chinese growth (with its implications for the terms of trade of natural resource-abundant economies), and the seemingly inevitable normalisation of monetary policy in the US, can only deepen the ongoing growth deceleration in the emerging world. Latin America is no exception – growth has fallen from about 6% during the 2010 crisis recovery peak to around 3% in 2012, and to an estimated 2.5% in 2013.

But sceptics go further to argue that any progress over the past decade was largely a mirage; that the region metabolised the terms of trade and capital inflows bonanza into a consumption-driven, credit-fuelled expansion, missing a development opportunity by failing to build the foundations for productivity growth. In its stronger version, this pessimistic view predicts that the deterioration of the external environment will expose the region’s dependence on foreign finance and, as a result, the downturn will end up in tears (the type of macroeconomic and financial havoc that the region tended to experience in the 1990s).

This view conflates two distinct preoccupations:

Concerns about the growth trend – the presumption that once global tail winds recede, Latin America will be back to its historically low long-term growth rate.

Concerns about the cycle – the possibility of a dramatic slowdown amplified by financial stress, 1990s-style.

Is this twice negative outlook justified?

New research

As we argue in a recent report (de la Torre et al., 2013b), preoccupations with the trend are only partially justified; those with respect to the cycle are definitely not merited.

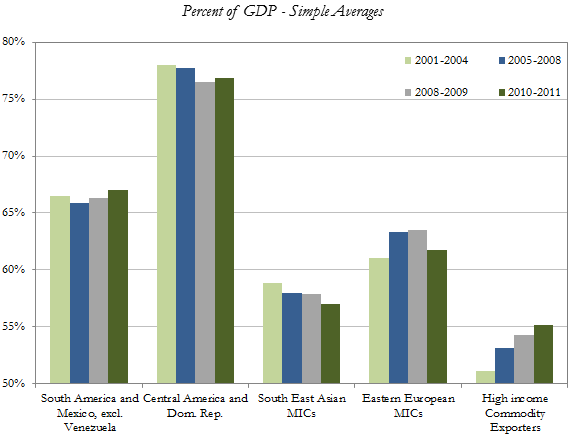

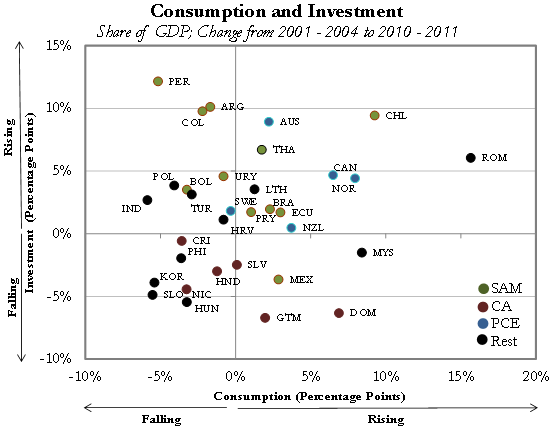

Consider first the worries with trend growth. The region’s last decade of social and economic progress was far from an illusion. Growth was indeed driven by domestic demand (and not by external demand, as in Asia). But for most large countries in the region it was largely an investment rather than a consumption story.

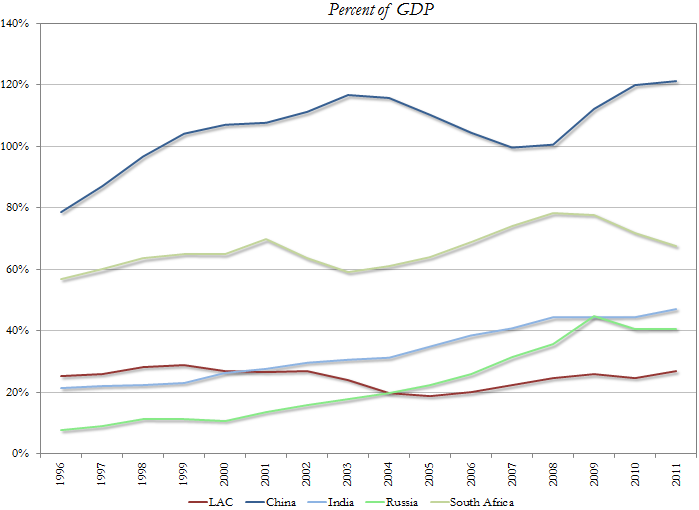

When measured in terms of real ratios to GDP (nominal ratios underestimate investment in times of rising terms of trade), regional investment rates rose significantly, and now compare favourably to those in the east Asian middle-income countries (Figure 1).

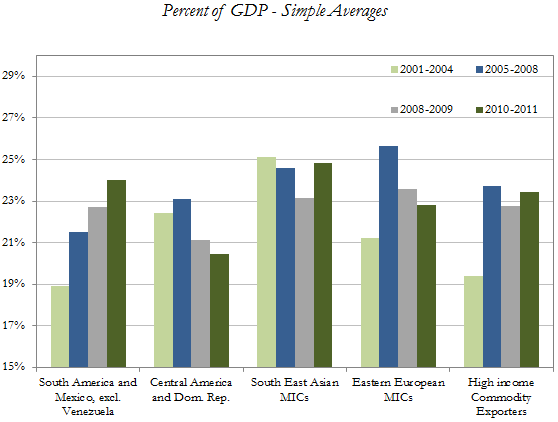

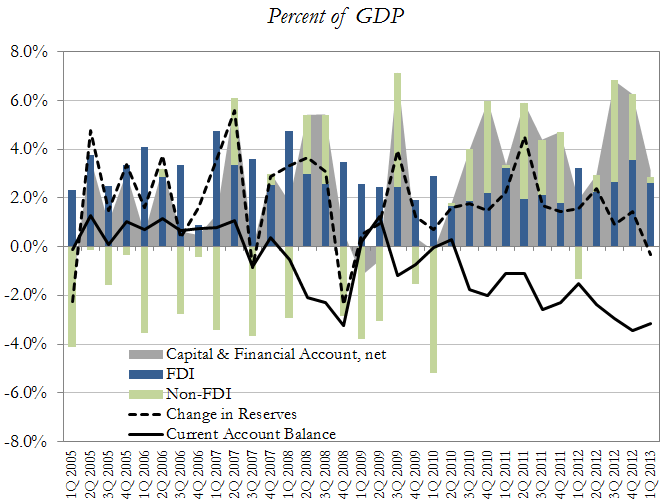

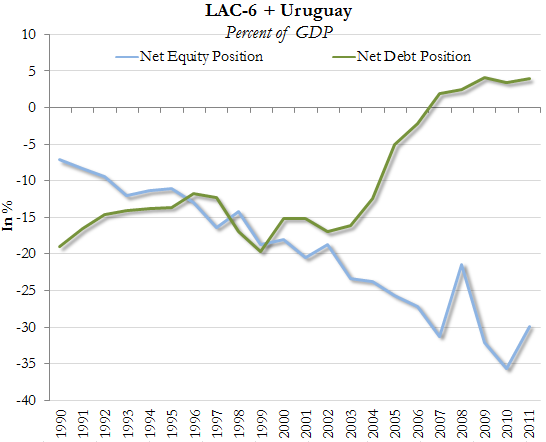

Current-account deficits – which mirror the domestic demand-driven growth – have been largely financed not by short-term portfolio inflows, as commonly believed, but by diversified foreign direct investment (Figure 2).

Brisk consumer credit expansion has naturally raised some policy concerns; however, overall credit growth was moderate (Figure 3). Moreover, it is closely monitored by strict regulatory authorities, and does not pose significant systemic risk.

The social progress over the last decade was real enough. Some 70 million Latin Americans left poverty, and some 50 million joined the middle class (see Ferreira et al. 2013).

This progress may stall and lead to frustrated expectations in a low-growth scenario, but it is unlikely to be fully reversed.

In short, the region did fall short of implementing long standing productivity-enhancing reforms (closing the gaps in such crucial dimensions, as education quality and skill formation, physical infrastructure, and technology adoption). Yet, the conclusion that Latin America’s past decade of growth with equity was merely a consequence of short-lived supportive global economic conditions, is a misleading oversimplification.

Figure 1. Composition of Latin America’s domestic demand

Panel A: Private consumption

Panel B: Investment

Panel C. A comparative look at LAC’s real domestic demand

Notes: Demand components are measured in constant 2005 LCUs. SAM stands for South America and Mexico (exl. Venezuela). Central America and Dom. Republic (CA): Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras and Nicaragua. South East Asian MICs: Indonesia, Malaysia, Philippines, South Korea, and Thailand. Eastern European MICs: Croatia, Estonia, Hungary, Lithuania, Poland, Romania, Slovakia and Turkey. Peripheral Core Economies (PCE): Australia, Canada, New Zealand, Norway and Sweden.

Source: de la Torre, Levy Yeyati, and Pienknagura (2013a).

Figure 2. LAC-6 current-account financing

Notes: LAC-6 includes Argentina, Brazil, Chile, Colombia, Mexico, and Uruguay. Peru was not included because balance of payments data under IMF- BPM6 format was available until 2Q 2012. In Panel B, positive values of the financial account represent net inflows.

Sources: de la Torre, Levy Yeyati and Pienknagura (2013b).

Figure 3. Private credit by financial institutions

Notes: Private credit comprises deposit money banks and other financial institutions.

Source: WDI, World Bank.

Cycle-related concerns

The second preoccupation involves the view that the region’s traditional macro-financial (cyclical) vulnerabilities have not radically changed, and may, therefore, lead to a revival of a 1990s-style systematic financial instability. We believe these concerns miss the point by overlooking two fundamental changes.

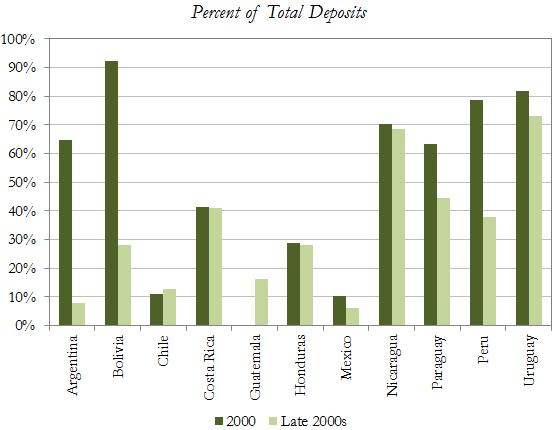

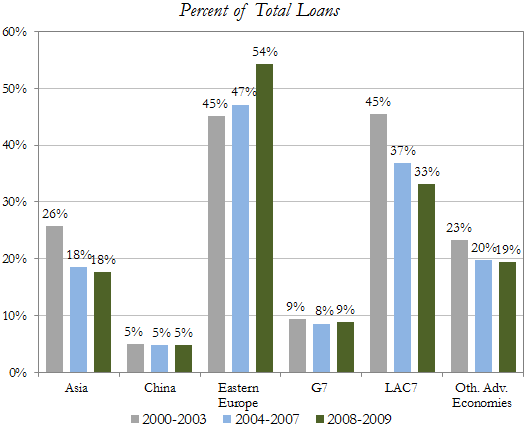

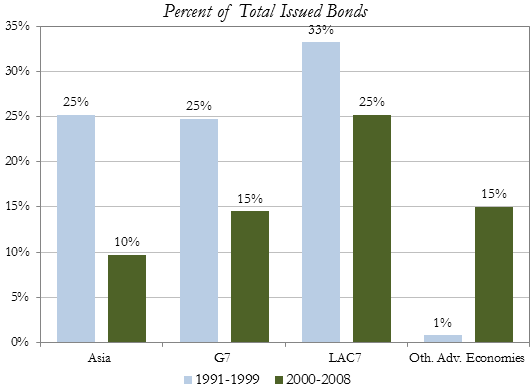

First, there has been a significant de-dollarisation of financial contracts, which substantially reduces the adverse effects of currency depreciations on the balance sheets of debtors (households, firms and government) (Figure 4).1´┐ŻTo the extent that emerging crises – if the 1990s were, for the most part, currency crises bankrupting currency-imbalanced economies – a 1990s-style crisis simply cannot be engineered in the Latin American de-dollarised economies of today.

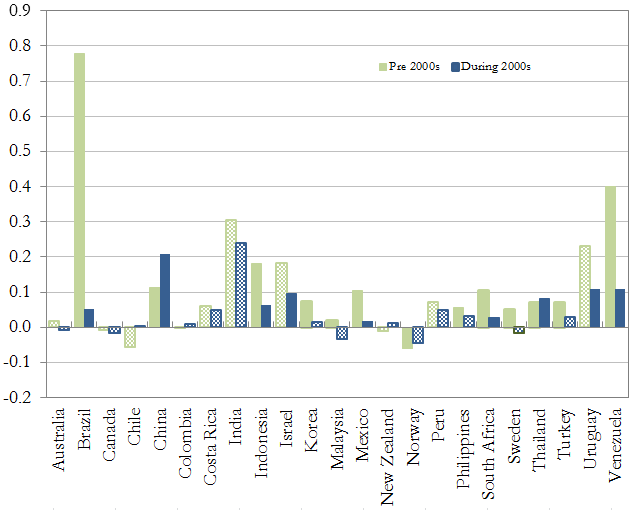

Second, the substantial decline in the exchange rate pass-through to inflation (Figure 5).

This is a reflection of a more credible monetary policy that anchored expectations around the inflation target rather than the exchange rate or past inflation.2

Figure 4. Financial dollarisation in LAC

Panel A: Deposit dollarisation

Panel B: Loan dollarisation

Panel C: Private-sector foreign-currency bonds

Panel D: Net foreign asset position

Notes: In Panel A, for most countries, Late 2000s represent 2008-2009. For Bolivia, Costa Rica, Peru, and Uruguay, Late 2000s stands for the 2013 value. In Panel D, LAC-6 comprises Argentina, Brazil, Colombia, Chile, Mexico, and Peru. Sources: Levy Yeyati (2006); De la Torre, Ize, and Schmukler (2011); the updated and extended version of he dataset constructed by Lane and Milessi-Ferretti (2007), BIS, Central Banks of Boliva, Costa Rica, Peru, and Uruguay; and Dealogic.

Figure 5. Pass-through estimates across countries

Notes: Notes: Pass-through coefficients were derived from a country regression of annual inflation as dependent variable and lagged inflation, annual change in the nominal effective exchange rate and the output gap. Darker columns (without pattern lines) correspond to coefficients that were statistically significant at 95%. Sources: de la Torre, Levy Yeyati and Pienknagura (2013b) from Bloomberg, Haver and The World Bank.

By leaving behind these two fundamental sources of ‘fear of depreciation’, the region can – for the first time in recent history – rely on currency depreciations to absorb adverse external shocks and stimulate local economic activity. This should cushion the downturn as external tail winds fade, much as in the typical developed economy.3

Flexible exchange rates should enhance countercyclical monetary policy, whereby central banks can lower the interest rate to stimulate domestic economic activity in the context of falling external demand (thereby decoupling rising international dollar rates from local financing costs). Moreover, a weaker currency in a downturn can help keep the external current account under control and, at the same time, boost domestic output and employment by encouraging exports, as well as import substitution. Finally, by quickly adjusting the relative values of foreign and domestic assets, it can mitigate capital outflows (for example, by promoting 'bargain hunting' inflows). These benefits could not be fully realised during the 2008-2009 crisis because of its globally systemic nature (there was nowhere to export the recession to, despite the sharp currency corrections), but may be there now that foreign demand for Latin American exports (from China and the US) is still growing.

Conclusion

The outlook may not be as bright as in the mid-2000s when many observers overstated the region´┐Żs potential. But now, they seem to be understating it. By slowly purging the source of macroeconomic and financial fragility of the 1990s, Latin American economies have arguably turned the excruciating pain of financial crises into the run-of-the-mill unpleasantness of a conventional business cycle. The 1990s lenses, with which we are used to be looking at the region, need to be upgraded.

References

Bouakez, H and N Rebei (2008), “Has Exchange Rate Pass Through Really Declined? Evidence from Canada,”´┐ŻJournal of International Economics, Vol. 75, pp. 249–267.

Calvo, G and C Reinhart (2002), “Fear of Floating,”´┐ŻThe Quarterly Journal of Economics, Vol.117: pp. 379-408.

Daude C, E Levy Yeyati and A Nagengast (2013), “On the Effectiveness of Exchange Rate Intervention,” Mimeo, OECD.

De la Torre, A, A Ize, and S Schmukler (2011),´┐ŻFinancial Development in LAC: The Road Ahead, Washington, DC: World Bank.

De la Torre, A, E Levy Yeyati, and S Pienknagura (2013a).“Latin America and the Caribbean as Tailwinds Recede: In Search of Higher Growth,” LAC Semiannual Report (April 2013), The World Bank, Washington, DC.

De la Torre A, E Levy Yeyati and S Pienknagura (2013b), “Latin America’s Deceleration and the Exchange Rate Buffer,” LAC Semiannual Report (October 2013), The World Bank, Washington, DC.

Ferreira, F H G, J Messina, J Rigolini, L F L´┐Żpez-Calva, M A Lugo, and R Vakis (2013),´┐ŻEconomic Mobility and the rise of the Latin American Middle Class, Washington, DC: World Bank.

Ghosh, A (2013), “Exchange Rate pass-through, Macro Fundamentals and Regime Choice in Latin America,”´┐ŻJournal of Macroeconomics, Vol. 35, pp. 163–171.

Levy Yeyati, E (2006), “Financial Dollarization: Evaluating the Consequences”,´┐ŻEconomic Policy, January 2006, pp. 61-118.

Levy Yeyati, E and F Sturzenegger (2013). “Fear of Appreciation,”´┐ŻJournal of Development Economics, Vol. 101, pp. 233–247.

Mihaljek, D and M Klau (2008). “Exchange Rate Pass Through in Emerging Market Economies: What has Changed and Why,” In Bank of International Settlements,´┐ŻTransmission Mechanisms for Monetary Policy in Emerging Market Economies.

Murchison, S (2009), “Exchange Rate Pass through and Monetary Policy: How Strong is the Link,” Bank of Canada Working Paper 2009-29, October.

1´┐ŻSee de la Torre, Ize and Schmukler (2011) for a detailed discussion of Latin America’s process of financial de-dollarisation.

2 Broadly speaking, this decline mirrors the one observed in developed economies in the 90s (see, e.g., Bouakez and Rebei 2008, and Murchison 2009, for Canada and Chung et al., 2011 for Australia). Mihaljek and Klau (2008) document results similar to those reported in here for emerging economies, and Ghosh (2013) does the same for nine Latin American countries.

3 Calvo and Reinhart (2002) argued more generally that emerging economies suffered from what they called a 'fear of floating'. The argument we make here is that while some countries may still intervene to prevent excess volatility (see Daude, Levy Yeyati and Nagengast 2013) or to prevent appreciations of their exchange rates (“fear of appreciation” as documented in Levy Yeyati and Sturzenegger 2013), the large degree of financial de-dollarization and the reduction of the exchange rate pass-through (and least in the biggest Latin American economies) make the “fear of depreciation” rather outdated.

´┐Ż